In the complex landscape of business entities, choosing between a Limited Liability Company (LLC) and a Corporation is a pivotal decision. Each has unique characteristics that make them stand out, catering to certain areas while avoiding others. This article will delve into the fundamental differences between these two entities, providing a comprehensive understanding of their structures, taxation, ownership, management, formal requirements, and legal discrepancies.

What Is The Difference Between LLC And Corporation?

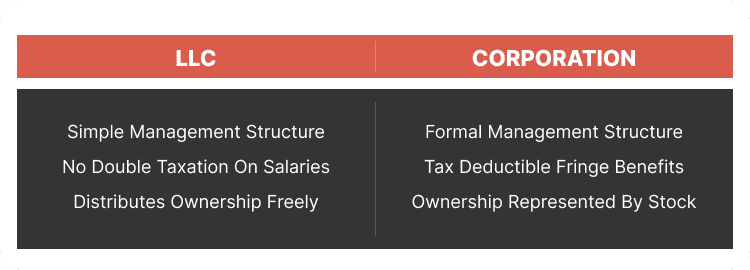

The fundamental difference between an LLC and a Corporation boils down to ownership and structure. An LLC is owned by members who directly hold the business’s assets and have flexibility in managing it. A Corporation is owned by shareholders who hold shares of stock and operate through a more formal structure with a board of directors and officers.

Need Help To Start Your Business?

Get It NowWhat Is an LLC (Limited Liability Corporation)?

An LLC, or Limited Liability Company, is a business structure that combines the tax benefits of a partnership or sole proprietorship with the limited liability protection of a corporation. This means that the owners of an LLC, called members, are not personally liable for the debts and obligations of the business. In other words, if the LLC goes into debt or is sued, the members’ personal assets, such as their homes, cars, and savings accounts, are generally protected.

What is a Corporation?

A corporation is a complex business structure where ownership (shares) and management (board, officers) are separate. Think of it as a giant team with its own legal identity, protected from owners’ personal debts. Profits flow through shared ownership, attracting investment and boosting growth, but with the complexity of formal rules and double taxation. Ultimately, corporations are powerful engines for large-scale business, though not always the simplest ride.

LLC vs. Corporation: Comparison

Taxes

LLC Taxes: LLCs offer a versatile approach to taxation. Single-member LLCs default to taxation as sole proprietorships, while multi-member LLCs default to partnership taxation. LLCs can choose to be taxed as a C corporation or an S corporation. This flexibility allows for tax optimization based on the business’s financial goals and circumstances. In addition, LLCs benefit from pass-through taxation, meaning business profits and losses flow through to the members’ individual tax returns. This eliminates the issue of double taxation faced by C corporations.

Corporation Taxes: Corporations are taxed as separate entities from their shareholders. They pay corporate income tax on their profits, and shareholders pay taxes on dividends received. However, S corporations can qualify for pass-through taxation, where corporate profits pass through to shareholders’ individual tax returns.

Business Ownership

LLC: LLC ownership is represented by membership interests. Members can be individuals, corporations, or foreign entities, each holding a percentage of ownership. This structure allows for flexibility in distributing ownership percentages and accommodating various stakeholders.

The ease of adding or removing members contributes to the adaptability of LLC ownership structures. Additionally, there are typically fewer restrictions on who can be a member compared to a corporation’s stringent rules regarding shareholder eligibility.

Corporation: Corporations issue shares of stock, and ownership is determined by the number of shares held. The advantage lies in the straightforward transferability of shares, making it easy for corporations to attract outside investors and facilitate changes in ownership.

Corporations can also issue different classes of stock, allowing for various voting rights and dividend preferences. This flexibility in structuring ownership is appealing to businesses aiming to raise capital through the sale of stock.

Management

LLC: LLCs can choose between member-managed and manager-managed structures. In a member-managed LLC, all members participate in decision-making, creating a collaborative approach. Alternatively, a manager-managed LLC designates one or more managers to handle day-to-day operations, providing a more centralized management style.

The absence of strict titles and roles in an LLC allows for a fluid and adaptable management structure. This flexibility is advantageous for businesses that value a less formalized approach to management.

Corporation: Corporations follow a more hierarchical management structure. A board of directors oversees major decisions, and officers handle daily operations. This formal structure ensures clear roles and responsibilities, making it suitable for larger businesses or those requiring a more traditional organizational hierarchy.

The delineation between shareholders, directors, and officers creates a well-defined system, allowing for specialized roles and responsibilities within the company.

Formal Requirements

LLC: LLCs generally have fewer formal requirements compared to corporations. While operating agreements outlining ownership and management details are recommended, some states do not mandate them. This provides additional flexibility for LLCs, especially smaller businesses with less need for extensive formalities.

Fewer mandatory meetings and less stringent record-keeping requirements make the LLC structure appealing to those who prefer a more straightforward and less administratively burdensome approach.

Corporation: Corporations face more formal requirements, including holding annual shareholder meetings, keeping detailed corporate minutes, and maintaining comprehensive record-keeping. While this may introduce a higher level of administrative complexity, it can also enhance transparency and governance.

The formal requirements of corporations are advantageous for businesses seeking a structured and well-documented approach to decision-making and governance.

Legal Discrepancies

LLC: LLCs provide members with limited liability, protecting personal assets from business debts and legal obligations. However, maintaining this protection requires strict adherence to business formalities, clear separation of personal and business finances, and compliance with state regulations.

The simplicity of compliance and the ability to customize operating agreements make LLCs an attractive option for those seeking liability protection without excessive administrative burden.

Corporation: Corporations, like LLCs, offer limited liability protection to shareholders. Strict adherence to record-keeping, annual meetings, and compliance with state regulations is essential to preserving this protection.

The well-established legal framework and widely recognized corporate structure of corporations make them an ideal choice for businesses that prioritize a strong legal foundation and seek to instill confidence in investors and stakeholders.

Is It Better To Have A LLC Or A Corporation?

Choosing between to get a LLC or a Corporation hinges on the specific needs, goals, and preferences of the business in question. For those valuing flexibility, simplicity in ownership and management, and less administrative burden, an LLC may be the preferred choice.

On the other hand, corporations offer a more formalized structure, making them suitable for businesses with growth aspirations, external investment plans, and a desire for a traditional organizational hierarchy. The decision ultimately rests on aligning the chosen entity with the unique characteristics and objectives of the business.

Form your LLC quickly

Answer a few questions and get help

What Is Better For A Small Business: LLC Or Corporation?

For a small business, an LLC is generally considered better than a corporation due to its flexibility in management, simpler administrative requirements, and tax advantages. LLCs offer limited liability protection without the need for a complex structure, allowing owners to avoid the double taxation faced by corporations by opting for pass-through taxation.

Additionally, LLCs have fewer formalities and reporting obligations, making them easier to manage for small business owners who may not have the resources to handle the extensive regulations that corporations must adhere to.

Difference Between LLC And Corporation: FAQs

What Is The Biggest Advantage A Corporation Has Over An LLC?

The primary advantage a Corporation holds over an LLC is the ease of transferability of ownership. Corporations issue shares of stock, making it simpler to attract external investors and facilitate changes in ownership compared to the membership interest structure of an LLC.

Can An LLC Turn Into A Corporation?

Yes, both LLCs and Corporations have the flexibility to convert from one entity type to another. This process involves filing the necessary paperwork with the state and adhering to specific conversion procedures outlined in state laws.

What Is The Difference Between An LLC and an LLP?

While both Limited Liability Companies (LLCs) and Limited Liability Partnerships (LLPs) offer liability protection, they differ in management and taxation. LLCs provide more flexibility in management structure and taxation options, while LLPs are designed for businesses where all partners want to participate in management and share liability.

What Is The Difference Between A Company And A Corporation?

A company is a broad term that refers to any business entity engaged in commercial activities, including sole proprietorships, partnerships, limited liability companies (LLCs), and corporations.

In contrast, a corporation is a specific type of company that is a separate legal entity from its owners, providing limited liability protection to its shareholders and having a more complex structure with a board of directors and officers. Corporations are subject to more regulations and can face double taxation, whereas other types of companies, like LLCs, can offer flexibility in management and tax treatment.

What Happens If You Start An LLC And Do Nothing?

If an LLC is established but no formal actions are taken, it may still be subject to state requirements, such as filing annual reports or paying fees. Inactivity doesn’t exempt the LLC from its obligations, and failure to fulfill these requirements may lead to penalties or the eventual dissolution of the entity.

Can A Corporation Be Owned By One Person?

Yes, a Corporation can be owned by one person. Such a structure is known as a “closely held” or “closed” Corporation, where a single individual or entity holds all the shares. This allows for the benefits of a Corporation, including limited liability, even with a sole owner.

How Many Years Can A Business Go Without Filing Taxes?

The specific duration a business can go without filing taxes varies based on factors such as its structure, revenue, and activity. However, businesses are generally required to file annual tax returns. Failure to do so can result in penalties, fines, or the loss of certain tax benefits.

Is Filing An LLC Expensive?

The cost of filing an LLC can vary based on factors such as the state, chosen service provider, and additional features like an operating agreement. While some states offer relatively low filing fees, it’s essential to consider the overall cost, including any required ongoing fees or compliance expenses.

Which Type Of Business Owner Is Best Suited For A Corporation?

Business owners aiming to scale their ventures by hiring employees and attracting outside investors may find a Corporation more suitable. The ease of share transferability and the established structure of a Corporation are appealing to investors seeking a well-defined and predictable business entity.

LLC vs. Corporation: Final Thoughts

The decision between choosing an LLC and a Corporation is a strategic one that requires a thorough understanding of the unique features each entity offers. This comprehensive guide aims to empower business owners with the knowledge needed to make informed choices aligned with their business goals. Whether prioritizing flexibility, ease of administration, or formalized structure, the choice between an LLC and a Corporation should be a deliberate step toward ensuring the long-term success of the business.