Choosing the right business structure is a significant decision for any entrepreneur. The two most popular options for small business owners are the Limited Liability Company (LLC) and the S Corporation (S Corp).

Both offer unique advantages and have specific implications for your taxes, personal liability, and business operations.

Need Help To Start Your LLC?

S Corp vs. LLC: Overview

According to the U.S. Small Business Administration, LLCs and S Corporations make up a large portion of the 33 million small businesses in the United States. Understanding their similarities, differences, and benefits can help you make the best decision for your business.

What Is an LLC?

An LLC, or Limited Liability Company, is a flexible business structure that combines the characteristics of a corporation and a partnership or sole proprietorship.

LLC owners, known as members, benefit from limited personal liability for business debts and obligations, similar to shareholders of a corporation. The LLC structure is known for its simplicity and flexibility in management and taxation.

What Is an S Corp?

Business owners must file Form 2553, Election by a Small Business Corporation, with the IRS to establish an S Corp. An S Corporation doesn’t pay corporate income tax like a traditional C Corporation. Instead, the company’s profits pass through to the owners’ personal tax returns.

A business entity can choose taxation as an S Corporation to avoid double taxation. Therefore, taxing income is only at the shareholder level, not at the corporate level. S Corporations are subject to specific regulations and requirements, including a limit on the number and types of shareholders allowed.

S Corp vs. LLC: Similarities

Despite their differences, LLCs and S Corps share several similarities. Here are ways the two structures overlap and how these aspects can affect your business:

Limited Liability Protection

LLCs and S Corporations offer limited liability protection to their owners. Usually, members of an LLC and shareholders of an S Corp are not personally responsible for business debts and liabilities. Protection is crucial because it helps shield personal assets in the event of business financial troubles or lawsuits.

Pass-Through Taxation

Another similarity is pass-through taxation. In both business structures, income passes through to the owners, who report it on their personal tax returns. Not having double taxation can lead to tax savings and simplified tax filing processes.

Separate Legal Entity

Owners consider both LLCs and S Corporations to be separate legal entities from themselves. This separation can provide credibility and continuity, as the business can continue to exist even if ownership changes.

It also means that the business can own property, enter into contracts, and conduct transactions independently of its business owner.

Compliance and Record-Keeping

While LLCs are generally less formal, each business entity requires some level of compliance and record-keeping. Both should maintain good standing with the state by filing annual reports and keeping accurate financial records.

Rigorous requirements help ensure the business operates within legal parameters and maintains its limited liability protection.

S Corp vs. LLC: Key Differences

Now that we’ve covered the similarities, let’s explore the key differences between the two. The differences can have significant implications for how your business operates and how much you pay in taxes.

Taxation

One of the most critical differences between LLCs and S Corporations is tax regulation. LLCs have flexible tax options.

By default, a single-member LLC is subject to taxation as a sole proprietorship. A multi-member LLC will be under the tax guidelines as a partnership. LLCs can also choose taxation as a C Corporation or an S Corporation.

S Corporations have a specific tax status that allows income, losses, deductions, and credits to pass through to shareholders’ personal tax returns.

It can result in significant tax savings, particularly in terms of self-employment taxes. However, this type of business structure has more stringent IRS requirements to maintain its status.

Ownership Restrictions

LLCs offer great flexibility because there can be more than one owner. In fact, there are no restrictions on the number or type of members an LLC can have. Members can be individuals, corporations, other LLCs, or foreign entities.

S Corporations are a bit different, and they face strict ownership rules. The structure allows multiple owners but limits the number of shareholders to 100, all of whom must be U.S. citizens or residents. Other corporations, LLCs, partnerships, or certain trusts cannot own an S Corporation.

Management Structure

Members can be in charge of LLCs and enjoy involvement in the day-to-day operations. Designated managers can also handle operations if they desire. This flexibility allows LLCs to tailor their management structure to fit their specific needs.

S Corps have a more rigid management structure. A board of directors oversees the major decisions and appoints officers to handle daily operations. This more formal business structure can provide clear roles and responsibilities but may also add complexity.

Profit Distribution

LLCs do not have a set way to distribute profits among members. The distribution doesn’t have to be proportional to ownership interest, allowing members to allocate profits and losses in a way that makes sense for the business.

An S Corporation must distribute profits and losses strictly in proportion to the shareholders’ ownership percentages. Doing it this way can affect business planning and compensation strategies. There is no flexibility in the way the business allocates income.

Formation and Ongoing Requirements

Forming and maintaining an LLC is generally simpler and involves fewer formalities than S Corporations. LLCs have to file articles of organization with the state, create an operating agreement, and possibly file reports annually.

S Corps must first incorporate by filing articles of incorporation. Beyond this, they have to adopt bylaws, issue stock, hold initial and annual director and shareholder meetings, and keep minutes of these meetings.

They must also file Form 2553 with the IRS to elect S Corporation status and ensure compliance with the Corporate Transparency Act (CTA). These additional requirements can be time-consuming and may require more administrative oversight.

S Corp vs. LLC: Pros & Cons

It’s essential to understand the pros and cons of LLCs and S Corporations to help you weigh your options and decide which structure is best for your business.

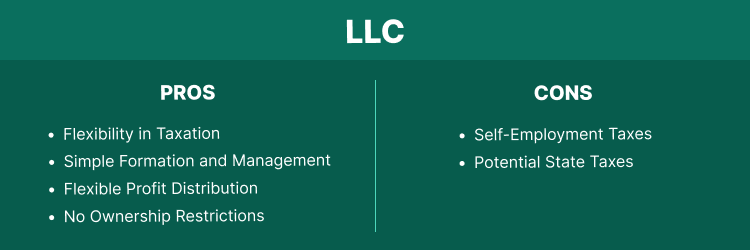

LLC

Pros

- Flexibility in Taxation: LLCs can choose taxation as a sole proprietorship, partnership, C Corporation, or S Corporation to minimize tax liability.

- Simple Formation and Management: LLCs have less red tape and paperwork compared to S Corporations.

- Flexible Profit Distribution: Customized financial arrangements are possible because LLCs can distribute profits and losses in various ways. It does not have to be proportional to ownership interests.

- No Ownership Restrictions: LLCs may have an unlimited number of members, including individuals, corporations, or other entities.

Cons

- Self-Employment Taxes: LLC members must pay taxes on their share of the business income, which can be substantial.

- Potential State Taxes: Some states impose additional taxes or fees on LLCs, which might add to the overall cost of maintaining the business entity.

S Corp

Pros

- Tax Savings: S Corporations do not pay federal taxes at the corporate level. As a result, the entity saves money, particularly regarding self-employment taxes.

- Credibility: The formal structure of an S Corporation can add credibility with customers, suppliers, and investors.

- Limited Liability: In general, shareholders are not personally liable for business debts and obligations.

Cons

- Complex Formation and Maintenance: S Corporations have more rigorous formation and compliance requirements. Regular annual meetings and keeping detailed records can be challenging.

- Ownership Restrictions: S Corps can’t have more than 100 shareholders, and all must be U.S. citizens or residents. These restrictions can limit growth and investment opportunities.

- Rigid Profit Distribution: Owners must distribute profits and losses in proportion to ownership, limiting flexibility.

Get Help to Start Your Business

Ensure Compliance and Avoid Penalties

Choosing the Best Structure for You

Deciding between an LLC and an S Corporation requires careful consideration of your business goals, financial situation, and operational preferences. We’ve already gone through the major differences between the two, so here’s a recap to help you choose:

Business Goals

What are your long-term business goals? If you plan to scale your business and attract investors, the formal structure and credibility of an S Corporation might be more advantageous. Investors often prefer the predictability and formalities of an S Corp. It includes issuing stock and having a board of directors.

If you want a simpler, more flexible structure, an LLC might be better. Limited liability companies are ideal for smaller businesses or those that plan to grow organically without significant outside investment.

Tax Implications

Evaluate the tax implications of each structure. Remember that LLCs offer versatility in taxation, which can be beneficial if your income fluctuates.

By default, the Internal Revenue Service taxes an LLC with one owner as a sole proprietorship and an LLC with multiple owners as a partnership. However, LLCs can also choose C Corporation or S Corporation taxation to optimize tax liabilities.

S Corporations can provide tax savings, especially for businesses with significant income, but they require more rigid compliance. More tax savings are available on self-employment taxes since distributions aren’t subject to the same regulations.

Careful planning and adherence to Internal Revenue Service rules is crucial to avoid penalties.

Ownership and Management

Think about your preferred ownership and management structure. Limited liability companies offer latitude in both areas, allowing you to tailor the business to your needs.

Less rigidity is particularly useful for businesses that want to distribute management responsibilities according to members’ expertise and involvement levels.

S Corporations have a board of directors in charge of all significant decisions and daily operations. It makes things flow smoothly but also adds complexity.

Administrative Burden

Consider the administrative burden of each structure. LLCs are usually easier to create and maintain because there aren’t as many formalities. You also don’t have as much paperwork to worry about.

S Corps require more administrative oversight, which can be time-consuming and may require professional assistance.

State Regulations

Check your state’s regulations and fees for LLCs and S Corporations. Some states have additional taxes or fees for LLCs, which can affect your decision. For example, certain states impose franchise taxes or annual reporting fees on LLCs that can add to the cost of maintaining the business.

Additionally, some states have different levels of regulatory scrutiny and administrative requirements for S Corps, which can impact your decision based on the ease of compliance and ongoing operational considerations. In the LLC requirements in California, for example, additional forms are necessary.

S Corporation & LLC FAQs

Here are the most commonly asked questions for people who are choosing between an LLC and an S Corporation:

Does an S Corp Pay Less Taxes Than an LLC?

It depends. S Corporations can save on self-employment taxes because only salaries are subject to these taxes, while distributions are not. The overall tax savings depend on your specific situation, including your income level and business expenses.

Can a Single Member LLC Be an S Corp?

Yes, an LLC owned by a sole proprietor can elect tax classification as an S Corporation by filing Form 2553 with the Internal Revenue Service. It’ll provide tax benefits but also requires adherence to certain regulations.

Should I Switch My LLC to S Corp?

Switching can provide tax savings and additional credibility. It also involves more administrative requirements and compliance. Consider your business needs, goals, and the potential tax benefits before making the switch.

Should My Startup Be an LLC or S Corp?

For startups, an LLC is a popular choice because of its versatility. If you anticipate significant income or plan to attract investors, an S Corporation might be beneficial for its tax advantages and formal structure.

Can My S Corp Pay My Personal Taxes?

No, an S Corporation cannot pay your personal taxes. The income, losses, deductions, and credits pass through to the shareholders, who are responsible for reporting and paying taxes on their personal returns.

At What Income Is S Corp Worth It?

S Corporation can be worth it when your business generates enough income to benefit from the tax savings on self-employment taxes. Generally, if your net income exceeds $40,000 to $50,000, it might be worth considering an S Corporation election.

Final Thoughts on S Corp vs. LLC

Choosing between an LLC and an S Corporation depends on various factors, including your business goals, tax situation, and operational preferences.

Both structures offer limited liability protection and pass-through taxation. They differ significantly in terms of ownership, management, and compliance requirements.

Consult with a registered agent or a business formation service for personalized advice. These professionals can help you understand each structure and make the best decision.