If you’re considering starting a new business entity, a single member LLC could be an ideal option. It’s a business structure often favored by freelancers, consultants, and small businesses looking for limited liability protection (LLP)and a straightforward way to pay taxes. This setup helps protect your personal assets and simplifies business income reporting.

This guide explains what a single member LLC is, how it differs from other business entities, and how it provides benefits like safeguarding your valuables and simplifying the process of filing tax forms.

Need Help To Start Your LLC?

Get StartedWhat Is a Single Member LLC?

A single member limited liability company (LLC) refers to a business entity owned by only one person, meaning you’re the sole owner. This business structure combines the advantages of a sole proprietor with the protection of a limited liability company, which shields your personal belongings from your business entity’s debts.

Legally recognized as a separate entity, the LLC protects you from being personally liable for the company’s obligations, ensuring that your personal accounts and other property are not at risk. Unlike a sole proprietor, where the owner and the business are treated as one, a single member LLC provides asset protection, giving you more security.

How Does a Single Member LLC Differ from Other LLCs?

While owners of both a single and multi-member limited liability company benefit from LLP, a key difference is that a single member LLC gets treated as a disregarded entity for tax purposes. This means the IRS considers the LLC’s income and losses part of your personal income tax, rather than treating the LLC as a separate taxpayer.

In comparison, a sole proprietorship offers no legal distinction between the owner and the business, which could expose your personal assets to greater risk. In addition, regardless of whether you run a sole proprietorship or an LLC, you need a taxpayer identification number (TIN) to fulfill your tax obligations.

Key Benefits of a Single Member LLC

Operating as a single member LLC provides significant advantages for the owner because it offers limited liability protection and tax flexibility. Below are some of the main benefits:

Limited Liability Protection

A single member LLC protects your personal assets from the company’s liabilities. Take business debts for example; in the event that your business faces lawsuits or debt, creditors can only pursue your company’s assets, not your personal property. This business structure helps you separate your business from your personal life, keeping you safe from potential financial disaster.

Tax Flexibility

A single member LLC enjoys the tax benefits of being treated as a disregarded entity, allowing the owner to report all business income on their personal tax return. You don’t have to file a separate business tax return unless you choose a different tax classification, such as being taxed as an S corporation.

Additionally, single LLC owners can deduct business expenses like filing fees, business licenses, and other costs to reduce their taxable net income.

Disadvantages of a Single Member LLC

Let’s get into the most significant disadvantage you might face.

Self-Employment Taxes

As single member LLC owners, you’re on the hook for self-employment taxes. This means paying both the employer and employee portions of Social Security and Medicare taxes, totaling about 15.3% of your earnings.

These taxes can significantly reduce your take-home pay. It’s vital to plan for this expense to avoid surprises at tax time.

Legal Considerations and Formalities

Setting up involves some legal hoops. You’ll need to comply with state-specific requirements, which can vary widely. This often means drafting an operating agreement and filing the necessary legal paperwork.

Moreover, maintaining your status involves annual fees and periodic filings with your state. Neglecting these formalities can jeopardize your business’s legal standing, so staying on top of these requirements is crucial.

Additionally, it’s important to note that opting to form an LLC instead of a corporation means you won’t be able to sell stock in your company, which could limit your options for raising capital and expanding the business entity.

Single Member LLC Taxes

Taxes for the owners come with distinct benefits. Here’s how you can effectively manage and minimize your tax obligations.

Pass-Through Taxation

With pass-through taxation, your business income flows directly to your personal tax returns. This setup means you pay income tax on your LLC earnings just like your personal income, simplifying how you pay taxes.

It keeps your tax filing straightforward, as you only deal with personal income tax forms. This integration helps streamline your tax responsibilities annually, ensuring you’re not overburdened by separate business taxes.

Filing as an S Corporation

Sometimes a single member LLC owner chooses to file as an S Corp to save on taxes. This strategy can significantly reduce payroll tax. You distinguish between regular income and business profits by paying yourself a reasonable salary.

This method requires meticulous filing of various tax documents but can offer substantial savings. Only your salary faces payroll taxes, while the remaining income, distributed as dividends, enjoys lighter tax treatment. This approach not only saves money but also protects your assets, keeping more of your earnings secure.

Learn more: LLC vs S Corp differences and benefits.

How to Form a Single Member LLC

This section explains how to form a Single-Member LLC business structure from start to finish.

-

Choose Your LLC’s Name

Choosing the right name for your LLC is the first crucial step in forming your business entity.

- Follow state naming rules (must include “LLC” or “Limited Liability Company”).

- Ensure the name is unique by checking your state’s website.

- Reserve the name if necessary.

-

Appoint a Registered Agent

Your LLC needs a Registered Agent to receive legal documents for your business.

- The agent must have a physical address in your LLC’s formation state.

- They will receive important legal documents on your behalf.

-

File Articles of Organization

Filing the Articles of Organization officially registers your LLC with the state.

- Submit your LLC formation document (often online) to the state.

- Include necessary information: LLC name, address, and Registered Agent.

-

Create an Operating Agreement (OA)

An OA is an internal document that outlines how your LLC will be run.

- Outline your management structure and profit distribution.

- Reinforce personal liability protection, even as a single owner.

- Obtain an EIN

An EIN is necessary for tax reporting and other business operations.

- Get an EIN from the IRS.

- Required for taxes, hiring employees, and opening a business bank account.

- Free online application is available via the IRS website.

-

Open a Business Bank Account

Opening a business bank account is essential for keeping your finances separate.

- Separate your business and personal finances.

- Use your EIN and Articles of Organization to open the account.

-

Obtain Necessary Licenses and Permits

Ensure your LLC is legally compliant by obtaining the required licenses and permits.

- Comply with state and local licensing requirements.

- Check for industry-specific permits (e.g., food services, healthcare).

-

File State Reports and Pay Fees

Maintain your LLC’s good standing by staying on top of state requirements.

- File required annual or biennial reports.

- Pay any state fees (e.g., franchise taxes) to keep your LLC in good standing.

Following these steps ensures your single member LLC is properly set up and maintained.

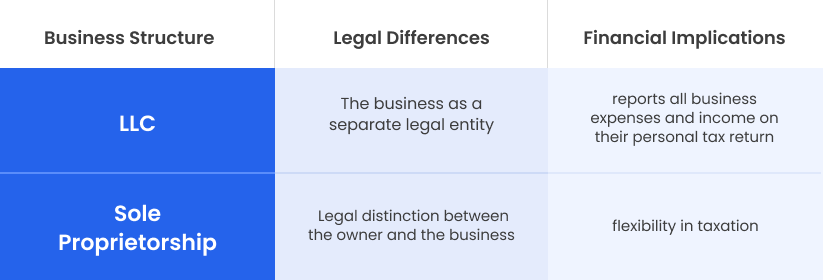

Single Member LLC vs. Sole Proprietorship

When deciding between a single member LLC and a sole proprietorship, understanding the differences in liability protection, taxation, and formalities is crucial. Each structure has its own implications for legal protections, financial management, and overall business operations.

Legal Differences

A sole proprietorship offers no legal distinction between the owner and the business, meaning the sole proprietor is personally liable for all debts and legal obligations. In contrast, a single member LLC protects liability by treating the business as a separate legal entity.

This shields the owner’s personal assets from business liabilities. It also offers a key advantage in the event of lawsuits or debt collection.

Financial Implications

Taxation and financial management differ significantly between each business structure. A sole proprietorship reports all business expenses and income on their personal tax return, while a single member LLC provides more flexibility in taxation.

Though both are subject to state income tax, a single member business entity can elect to be taxed as a sole proprietorship, on partnership income, or even as a corporation. Also, LLCs typically require a separate bank account, making distinguishing personal and business finances easier.

Both entities may require a taxpayer identification number for tax purposes, though LLCs follow more structured formalities.

State Laws Governing Single Member LLCs

State regulations for a single member LLC can vary widely. Some states simplify the process, while others have stricter rules or higher fees. To stay in good standing, you’ll need to follow your state’s specific requirements.

This might include filing annual reports and paying fees. You’ll also need to handle state income tax obligations if applicable. Missing these steps can lead to penalties or even the dissolution of your LLC.

Choosing Your State of Incorporation

Choosing where to form your LLC is an important decision. Some states, like Delaware, are known for being business-friendly. Others may have higher fees or more complex rules. Foreign LLCs are a different story. If your business operates in another state, you may need to register as a foreign LLC, which adds extra steps.

Consider how many tax-related forms are required and what ongoing reports you’ll need. These factors can affect your costs and how you run your business long-term.

When Should You Choose a Single Member LLC?

A single member LLC is a great choice for many small businesses. It might be the perfect fit if you’re a freelancer, consultant, or a solo entrepreneur who wants to start a new business.

This structure offers limited protection, which keeps your personal assets separate from your business debts. In the event of business difficulties, your house, savings, and personal property remain safeguarded.

It’s also a good option if you want to run your business independently but still have some legal safeguards. Unlike a sole proprietorship, an LLC gives you a bit more credibility with clients and vendors. There are also fewer restrictions than other business structures.

You might also find it easier to open a business bank account or secure a loan. Plus, you get to enjoy the flexibility of running your business however you want, without the formalities of a larger corporation.

If your business is growing and you’re worried about personal risk, an LLC can help ease those concerns. It’s ideal for anyone who wants to keep things simple but still needs protection.

Freelancers, consultants, and small business owners benefit the most. You can also manage taxes more flexibly, deciding how your LLC is taxed based on your business needs.

Common Mistakes to Avoid When Managing a Single Member LLC

One common mistake is mixing personal and business finances. Always keep separate bank accounts to protect your liability. If you don’t, you could lose the legal protection an LLC offers. Another error is failing to pay self-employment taxes. As the sole owner, you’re responsible for paying these taxes directly to the IRS. Missing this step can lead to penalties.

Neglecting paperwork is another big issue. Many forget to file annual reports or renew licenses on time. This can result in fines or even the suspension of your LLC. Also, make sure you maintain proper records, especially for major business decisions. It’s easy to overlook, but good record-keeping helps you avoid legal problems later.

To stay organized and compliant, consider seeking specialized help. Compare LLC services to find the best option for your business.

Maintaining Your Single Member LLC: Ongoing Compliance

Running a single member LLC isn’t a one-time setup. You need to keep up with ongoing compliance to stay in good standing. This means meeting annual requirements like paying filing fees and renewing business licenses. Each state has its own rules, so it’s important to know your specific deadlines.

Always keep your personal and business finances separate. Mixing them can blur the line between you and your LLC as a separate entity. If you don’t, you risk losing the liability protection your LLC provides. Maintaining a clear distinction between personal and business accounts will protect your assets and simplify tax reporting.

Also, stay on top of other documentation, like annual reports, if your state requires it. These reports update your business’s information with the state. Missing a deadline could lead to penalties or even the suspension of your LLC. Keeping organized and setting reminders for these requirements can save you time and hassle.

Ensure Compliance and Avoid Penalties

Get Help to Start Your Business

Single Member LLCs and Business Insurance

Even with an LLC, business insurance is crucial. The most common type is liability insurance. It covers you if your business faces legal claims, like property damage or injuries. For freelancers or consultants, professional indemnity insurance is key. This protects you if a client claims your services caused them financial loss.

If you rely on your business for income, consider health insurance for yourself as the owner. It’s easy to overlook, but being uninsured can lead to huge costs. Lastly, property insurance might be necessary if you have equipment or inventory. Insurance adds a layer of protection, helping your LLC stay safe from unforeseen events.

Single Member LLC FAQs

Do Single Member LLCs Have To File Separate Tax Returns?

No, single member LLCs generally don’t have to file separate tax returns. The IRS treats the LLC as a disregarded entity. This means the net income from the business is reported on your personal tax return.

However, you can elect to have your LLC taxed as a corporation if that structure better suits your needs. It’s important to understand the difference between LLC and corporation to make your decision.

Can A Single Member LLC Hire Employees?

Yes, even though there’s only one owner, a single member LLC can hire employees. You’ll need an Employer Identification Number (EIN) to handle payroll taxes and file the necessary paperwork. Hiring employees does not change the fact that the LLC has one owner, but it adds responsibilities related to employment laws.

Do I Need An Operating Agreement For A Single Member LLC?

While many states don’t require an Operating Agreement, it’s highly recommended. It helps define how your business is run, even if there’s only one owner. This document is important because it reinforces that the LLC is a separate legal entity from your personal accounts. Without it, you may face challenges in proving your LLC’s independence in legal matters.

Final Thoughts

A single member LLC offers flexibility and essential protections, making it a viable option for anyone starting a business solo. It provides significant asset protection and tax benefits, ensuring entrepreneurs can focus on growth while maintaining personal financial security. However, it requires strict adherence to legal formalities and diligent financial separation.

Managing a single member LLC effectively ensures compliance and maximizes its advantages. As a strategic choice, this structure can substantially alter how individuals mitigate business risks and capitalize on opportunities applicable to various professional endeavors.

Considering the Single Member LLC not just as a business entity but as a personal asset management strategy could redefine your financial landscape.

Disclaimer: The content of this article is for informational purposes only and does not constitute legal advice. It is not intended to substitute professional legal counsel. Always consult a qualified attorney for any legal issues or concerns specific to your situation.