A limited liability company (LLC) is one of the most popular business structures for entrepreneurs today. Its appeal lies in combining personal asset protection and flexibility in management and taxation. But what is an LLC, exactly? In this article, we’ll explain the basics of LLCs. You’ll learn why small business owners prefer them, how they differ from other models, and much more!

What Is an LLC?

An LLC, or Limited Liability Company, is a business structure designed to protect personal assets from business liabilities such as debts or lawsuits. This ensures that your personal finances remain separate from your business obligations.

LLCs also offer flexible taxation and management options. You can choose how the entity is taxed, either as a sole proprietorship or partnership. You can also decide whether to manage the business yourself or appoint managers, tailoring the setup to best suit your needs.

How an LLC Works?

A limited liability company (LLC) offers a blend of protection and flexibility. As an owner, you are insulated from the company’s debts and legal troubles, safeguarding your personal liability for personal assets, such as your home and savings, if the business encounters financial issues or lawsuits.

Ownership in an LLC is held by its members, who can be individuals or other entities. Each member’s contribution to the business often defines their percentage of ownership, and this flexibility allows LLCs to adapt to various business models and needs.

In terms of management, LLCs can be either member-managed or manager-managed. In a member-managed LLC, all owners participate in day-to-day decision-making, while in a manager-managed setup, owners may appoint managers (who may or may not be members) to handle these responsibilities. This choice provides a level of operational flexibility not always present in other business forms.

Financial responsibilities within an LLC include tax filing and account management. LLCs can choose their tax classification, allowing them to be taxed as partnerships or opt for a corporate tax status, which can significantly influence their financial planning and tax liabilities. However, it is important to note that many states impose a franchise tax on LLCs, which can impact overall costs.

The flexibility of an LLC extends to profit distribution, with members potentially receiving payouts according to initial investments or other criteria set forth in the operating agreement. This system ensures that LLC profits sharing is tailored to the business’s unique structure and goals.

Roles of LLC Members

LLC members are integral to the operation, contributing not just capital but also making key business decisions. Typically, voting rights are distributed equally among members, though arrangements can vary if stipulated, such as providing more influence to larger investors.

Llc Profits sharing among LLC members is also variable. While some LLCs distribute earnings equally, others allocate profits proportional to each member’s stake as outlined in the operating agreement, allowing for flexible financial arrangements tailored to each member’s contribution and the business’s strategic goals.

LLC Operating Agreement

The operating agreement of a limited liability company (LLC) details its business structure, outlining LLC members‘ roles, daily operations, and how conflicts are resolved. This document, while not legally mandatory in every jurisdiction, plays a critical role in preventing misunderstandings and ensuring smooth governance. This is vital for the internal organization similar to what is found in corporations.

This agreement delineates each member’s stake, responsibilities, and the protocol for ownership changes, acting as a governing contract for internal operations. It is essential to ensure that all members are clear on their roles and the procedures for managing the LLC, highlighting the customizable nature of this business structure.

LLC Laws & Requirements

An LLC is a popular business entity because it offers flexibility and protection. One of the primary features is limited liability, which protects your personal assets from business liabilities. It’s also a separate entity from its owners, meaning your personal income is separate from business assets.

LLCs benefit from flexible taxation. You can choose to be taxed as a disregarded entity or elect to be taxed as an S corporation or C corporation. Many LLC owners choose to pay self employment taxes, covering Social Security and Medicare. Compliance is simpler than for corporations, with fewer state requirements and less paperwork.

Each state has its own rules governing LLCs. State law dictates how limited liability companies are formed, taxed, and maintained. For federal tax purposes, the Internal Revenue Service follows the Internal Revenue Code to determine how LLCs are taxed based on the chosen tax status. Additionally, understanding the rules for transacting business and how to properly transact business in various jurisdictions is essential for maintaining compliance and protecting your LLC’s limited liability.

LLC State Acts

Each state has its own set of laws, known as LLC Acts, that govern the formation and operation of LLCs. These acts detail how to establish an LLC, what documents to file, and how to maintain the business. Notable state acts include the Delaware LLC Act and the California Revised Uniform LLC Act.

These acts also specify rules on dissolution and member rights. Knowing your state’s laws is crucial, as some states favor certain businesses.

Limited Liability Protection

One of the key features of an LLC is the legal protection it offers. LLC members are generally not personally responsible for the company’s debts. This means your personal assets, like your home or car, are protected from business liabilities. This protection makes LLCs stand out compared to sole proprietorships and partnerships.

However, limited liability isn’t absolute. In cases of fraud, personal guarantees, or certain debts, members could still be held liable. It’s essential to understand your state’s rules on personal liability to avoid potential legal risks.

Operating Agreement Requirements

An Operating Agreement is an internal document that outlines how the LLC operates. While not always legally required, it’s highly recommended. This document details roles, responsibilities, profit distribution, and procedures for resolving member disputes.

Even in states where it’s not mandatory, like Delaware, having a written agreement helps avoid misunderstandings. It serves as a roadmap for the LLC’s daily operations and long-term goals, making it a key document for any LLC.

Registered Agent Requirement

Every LLC must have an LLC’s registered agent. This person or service receives legal documents, ensuring the business remains in good legal standing. The agent must have a physical address in the state where the LLC is registered.

Failing to maintain a registered agent can result in legal issues, including missed legal notices. This could lead to the dissolution of the LLC, so it’s crucial to ensure the agent is always available during business hours.

LLC Naming Rules

Choosing the right name for your Limited Liability Company (LLC) involves following specific state rules. The name must be unique and cannot be similar to any existing business in your state. Most states also require that the name includes “LLC” or “Limited Liability Company” to clarify the business structure.

Before registering, you should check your state’s database to ensure the name is available. Some states also allow you to reserve a name for a limited time while you prepare to file your LLC formation documents.

Articles of Organization

To legally form your LLC, you must file Articles of Organization with your state’s government. This document typically includes your LLC’s name, address, member information, and the designated registered agent. Filing this document is the official step to creating your LLC as a separate legal entity.

Each state has its own requirements for Articles of Organization, so it’s essential to ensure you include all necessary information. Once filed, the LLC becomes a legal entity recognized by the state.

Taxation Laws

LLCs have flexible tax options under the Internal Revenue Code. By default, single-member LLCs are taxed as disregarded entities, while multi-member LLCs are taxed as partnerships. You can also choose to be taxed as an S corporation or a C corporation, depending on what benefits your business entity most.

The Internal Revenue Service (IRS) and state tax authorities oversee LLC taxation. Each LLC must decide how to handle income tax and self-employment tax based on its structure and the owner’s preferences. It’s important to consider potential franchise tax obligations, as these can impact overall taxable income and the business’s financial planning. A proper understanding of both federal taxes and state law is crucial for compliance and optimizing tax outcomes.

LLC Annual Reports

Many states require LLCs to file annual or biennial reports to maintain their status. This report typically includes updated information such as addresses, members, and the LLC’s registered agent. Filing fees vary by state, but missing the deadline can result in fines or penalties.

Failure to submit an annual report can lead to serious consequences, including the dissolution of your LLC. Keeping your business entity in good standing is essential to avoid costly reinstatement processes.

Foreign LLC Registration

If your LLC plans to operate in a state other than where it was formed, you must register as a foreign LLC in that new state. Each state has its own rules for foreign registration, but the process typically involves filing forms and paying fees.

Operating without registering as a foreign LLC can lead to fines and prevent you from enforcing legal contracts in that state. Following each state’s foreign LLC laws is crucial for expanding your business operations.

Member Liability and Fiduciary Duties

LLC members or managers often have fiduciary duties to the LLC and its members. These duties include acting in the best interest of the LLC and avoiding conflicts of interest. Fiduciary duties are typically outlined in state LLC laws and may include loyalty, care, and good faith responsibilities.

Violating these duties can result in legal action from other members of the LLC itself. It’s important to understand your fiduciary duties and act accordingly to protect the LLC and its members.

Dissolution and Winding Up

When an LLC dissolves, it must go through a formal process known as “winding up.” This involves settling debts, liquidating assets, and distributing remaining funds to members. State laws dictate the specific steps required to dissolve an LLC.

Failure to properly dissolve an LLC can result in ongoing tax liabilities and fees. Ensuring you follow state guidelines for dissolution protects the LLC from further obligations and ensures a clean exit for its members.

LLC Conversion and Mergers

Many states allow business entities to convert into LLCs or merge multiple LLCs into one. The process typically involves filing a Certificate of Conversion or Certificate of Merger with the state. These actions must follow state-specific guidelines and usually require legal documentation.

Conversions and mergers can offer tax benefits and simplify business operations. However, it’s important to understand the legal implications and requirements for each action before proceeding.

Different Types of LLCs

Choosing the right LLC type depends on your business needs. Each offers unique benefits, suiting different operational styles and legal requirements.

- Single-member LLC: Ideal for sole owners. You get liability protection with simple tax procedures. It’s straightforward and easy to manage.

- Multi-member LLC: Best for partnerships or groups. This structure allows for shared profits and losses with flexible management options.

- Series LLC: Perfect for businesses managing diverse assets. You can separate assets into different series, each with its own liability protection.

- Domestic LLC: For operations within its state of formation. It adheres to local business laws and regulations, simplifying compliance.

- Foreign LLC: If your LLC is formed in one state but operates in another, it’s considered foreign. This type requires compliance with multiple state regulations.

- Professional LLC (PLLC): Necessary for certain professionals like doctors or lawyers in some states. It offers liability protection tailored to professional services.

Benefits of an LLC

Forming an LLC brings several deep advantages, from personal asset protection to tax benefits and simpler compliance compared to other structures.

Liability Protection

With an LLC, your personal assets are safe. If your business faces debts or lawsuits, your personal wealth is untouched. You can take business risks without personal loss. This clear separation boosts your confidence, making expanding and experimenting in your business endeavors safer.

Tax Flexibility

With an LLC, you choose how to handle taxes. Opt for pass-through taxation to avoid double taxation or choose corporate status, fitting your financial strategy. This choice lets you minimize tax liabilities, adapting as your business grows, which can be a game changer financially.

Simple Compliance

LLCs face fewer formalities than corporations. Less paperwork means you spend less time on compliance and more on what matters—your business’s growth. This simplicity saves you time and money, reducing the hassle of legal obligations and letting you focus on operational success.

Management Flexibility

You can manage your LLC yourself or hire managers. This flexibility is perfect for adapting to your business’s evolving needs. Whether hands-on or overseeing, the ability to switch management styles helps you stay effective and responsive to your business’s demands.

Credibility

An LLC boosts your business’s credibility. This can open doors, making it easier to get funding and secure contracts. Being recognized as a legitimate business enhances trust with partners, suppliers, and customers, which can significantly aid growth.

Pass-Through Taxation

Enjoy the benefits of pass-through taxation with an LLC. This avoids the double taxation typical of corporations, simplifying your finances. This efficiency keeps more money in the business or your pocket, aiding reinvestment and better financial planning.

Need Help to Start Your Business?

Get StartedLLC vs Other Business Structures

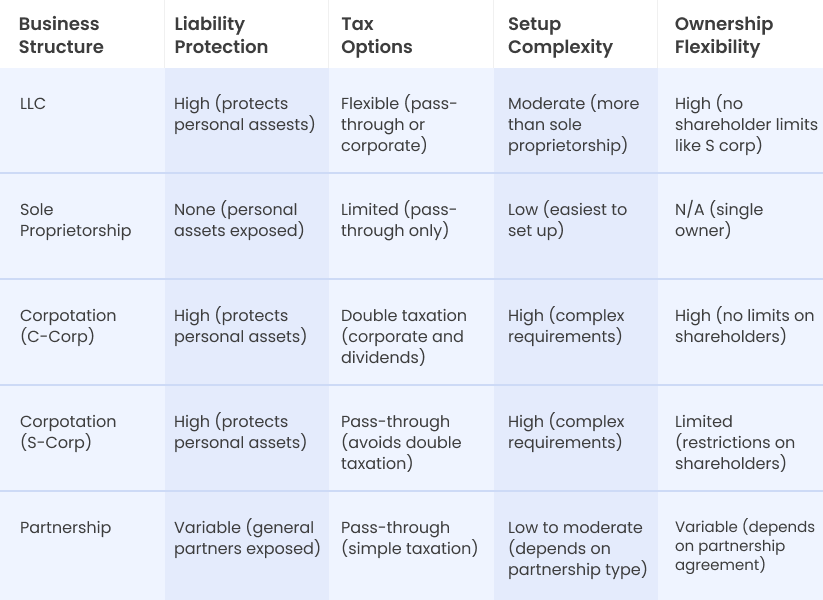

When choosing a business structure, comparing LLCs with sole proprietorships, corporations, and partnerships is crucial. Each option has unique legal and tax considerations that can impact your business.

LLCs offer personal asset protection, shielding personal property from business liabilities. This is a key advantage over sole proprietorships, which do not separate personal and business assets and expose personal assets to business risks.

LLCs differ from corporations in taxation and ownership rules. While C corporations suffer from double taxation on profits and dividends, LLCs and S corporations benefit from pass-through taxation, which avoids this issue.

Unlike partnerships that provide pass-through taxation but limited liability protection, LLCs offer both, combining the tax benefits of partnerships with the liability protection typically associated with corporations.

LLC vs Sole Proprietorship

An LLC separates your personal assets from your business liabilities, offering protection against business debts and legal actions. In contrast, a sole proprietorship does not provide this separation, exposing your personal assets to potential business risks.

Taxation for LLCs offers flexibility. They can choose to be taxed as a sole proprietorship, partnership, or corporation. Sole proprietorships benefit from pass-through taxation but lack the tax choices available to LLCs.

Setting up an LLC is more complex and involves more paperwork and fees than establishing and maintaining a sole proprietorship, which is generally simpler. However, the added protection and flexibility often make an LLC worth the extra initial effort.

LLC vs Corporation (C-Corp, S-Corp)

LLCs provide tax flexibility that C corporation entities do not. They allow for pass-through taxation, which avoids the double taxation C corporations face. LLC owners can have profits taxed directly to their personal income, bypassing corporate tax.

S corporations offer pass-through taxation but restrict their shareholders to 100 U.S. citizens or residents, unlike LLCs which impose no shareholder restrictions. This makes LLCs more adaptable for various business sizes and international participation.

Lastly, LLCs face less stringent regulatory demands compared to C corporations. They are not required to hold formal annual meetings or maintain extensive records. This simplifies operations and reduces bureaucratic overhead, which can benefit smaller businesses.

LLC vs Partnership

LLCs protect individual members from personal liability for business debts, unlike general partnerships, which share liability.

Both LLCs and partnerships offer pass-through taxation, meaning the business itself doesn’t pay taxes—profits and losses are reported on the owners’ personal tax returns. However, LLCs offer greater flexibility in how profits and losses are allocated among members.

Structurally, partnerships require a mutual agreement on decision-making and profit-sharing, which can be less formal than an LLC, which requires an operating agreement and more formal management structures. This can make partnerships appealing for simpler operational setups.

How to Start an LLC

Here’s a step-by-step guide to help you set up your LLC correctly:

- Choose an LLC Name: Select a unique name that complies with your state’s regulations. It must include “LLC” or “Limited Liability Company” and be distinguishable from existing names.

- File Articles of Organization: These are essential for formally establishing your LLC and must be filed with the state where your business will operate. They should include basic details like your LLC’s name, address, and members.

- Designate a Registered Agent: Appoint a registered agent or LLC service to handle legal documents for your LLC. This agent must be available during regular business hours and be based in your LLC’s state.

- Draft an Operating Agreement: While not mandatory everywhere, this agreement is vital. It details your LLC’s structure, member roles, and internal management, which is crucial for preventing disputes.

- Obtain an EIN from the IRS: The Employer Identification Number is necessary for tax filing, hiring, and setting up a business bank account. It’s free and available via the IRS website.

- Apply for State Business Licenses (if applicable): Your LLC may need specific licenses, especially if it offers professional services. Check local and state regulations to comply.

- Open a Business Bank Account: Keep your personal finances separate from your business by setting up a specific bank account for your LLC. This step is key for clear financial management.

- File Necessary Annual Reports: Stay compliant with state laws by filing required annual or biennial reports. These confirm your LLC’s operational details to the state.

If you need more details, read our complete guide on how to get your LLC.

Costs Associated with Forming and Maintaining an LLC

Starting and running an LLC involves various costs that vary by state. Knowing these costs upfront helps you budget effectively and ensures your business complies with all legal requirements.

The initial cost to start an LLC includes a filing fee, depending on your state. These are paid to the state to register your LLC officially. Also, you might spend on an operating agreement ($0-$600) to outline the LLC’s operating procedures and member roles. And publication fees ($40-$1,500), which are required in some states to announce your new business.

- Initial filing fees: These typically range from $35 to $500. This is a mandatory state fee to register your LLC.

- Annual renewal fees: Depending on the state, you could pay between $10 and $800 annually to keep your LLC in good standing.

- Registered agent fees: Costs between $0 and $300 per year. A registered agent receives legal documents on behalf of your LLC.

- Licenses and permits: These vary widely but can start from $50 and go beyond $1,000, especially if your LLC provides professional services.

Ongoing costs include annual report fees. These fees cover the filing of periodic reports with your state to maintain your LLC’s active status. Take Note: Keeping track of these fees and filing on time helps avoid penalties and ensures your business remains in good legal standing.

Taxation of LLCs

LLCs offer various taxation methods depending on the owners’ preferences. The most common option is pass-through taxation, which helps avoid double taxation and simplifies the process for LLC owners.

In pass-through taxation, the LLC itself does not pay corporate taxes. Instead, the owners report their share of the profits on their personal income tax returns. This means you only pay taxes on what you earn directly from the LLC, streamlining your tax obligations.

LLC owners must also handle self-employment taxes, which cover Social Security and Medicare. These taxes are calculated based on the owner’s share of the business profits. For example, if your LLC earns $80,000 and owns half, you’ll pay self-employment taxes on your $40,000 share.

Also, LLCs can choose to be taxed as a corporation. Electing this option allows the LLC to pay corporate taxes rather than passing income through to personal returns. This can be a strategic choice if the business plans to retain earnings or reinvest profits.

Pass-Through Taxation for LLCs

Pass-through taxation is a major perk for LLCs. This means business income passes directly to your personal tax returns, sidestepping the corporate tax level. Essentially, the business itself isn’t taxed—only the income you receive as an owner is taxable income. This setup simplifies your tax process and can lead to significant savings.

This taxation method is beneficial because it prevents the double taxation commonly faced by corporations. For federal tax purposes, reporting your business income is simple. It merges with your other personal income, streamlining your tax filing.

LLC Self-Employment Taxes

As an LLC owner, you’re responsible for self-employment taxes, which cover your contributions to Social Security and Medicare. Based on your share of the profits, these taxes are a critical part of your tax obligations and are paid directly through your personal tax returns.

Managing these taxes efficiently is essential to maintaining your financial health and ensuring compliance with federal requirements.

How to Maintain an LLC

Maintaining an LLC involves several key tasks to keep your business compliant with state and federal laws. Big or small business owners must regularly file paperwork, keep accurate records, and meet state regulations to avoid penalties and ensure smooth operations.

One of the most important requirements is filing an annual or biennial report. Meeting this requirement helps preserve the tax advantages of LLC status.

In addition, maintaining proper records is essential. This includes having a written operating agreement that outlines the roles and responsibilities within the LLC. Keeping your financial and legal documents organized is crucial for audits or legal matters. This can help prevent issues like unnecessary tax imposed due to missing or inaccurate information.

Filing Annual Reports

Most states require LLCs to file annual or biennial reports to update business details like ownership, address changes, and management roles. This process usually comes with a filing fee, varying depending on the state. Staying on top of these reports is crucial to keeping your LLC in compliance.

Missing a report deadline can lead to late fees or penalties. Sometimes, the state may even dissolve your LLC if reports are not filed on time. Timely filing ensures your LLC continues to operate legally and prevents unnecessary costs from accruing.

Keeping Business Records

Accurate record-keeping is essential for the smooth running of an LLC. Keep all financial statements, contracts, and tax filings organized and up to date. A written operating agreement is also a must to outline the roles and responsibilities of all LLC members, ensuring smooth internal operations.

Having well-maintained records helps when it’s time to file taxes or in case of a legal audit. It also provides clarity if any disputes arise within the business. Proper records support your financial planning and legal protection, giving you peace of mind in the long run.

Common Mistakes When Starting an LLC

Starting an LLC can be straightforward, but there are some common mistakes that can cause problems down the road. Avoiding these pitfalls will help ensure your LLC stays compliant and runs smoothly from the start.

- Not having an operating agreement: Even if your state doesn’t require it, having a written operating agreement is crucial. This document clearly outlines roles, responsibilities, and how the business is managed. Without it, disputes can arise, and legal issues may become complicated.

- Choosing the wrong state for formation: Some business owners mistakenly form their LLCs in a state with lower fees, even though they don’t operate there. You should form your LLC in the state where you do business, or you may face extra costs and legal complexities.

- Neglecting to maintain proper records: Failing to keep accurate financial and legal records can lead to penalties, missed tax obligations, or problems during audits. Organized documentation is key to avoiding legal and financial issues down the line.

- Not registering as a foreign LLC in other states: If you operate in multiple states, you must register your LLC as a foreign entity in each state. Failure to do so can result in fines and the inability to legally conduct business in those locations.

- Misunderstanding self-employment taxes: LLC owners are responsible for paying self-employment taxes, which cover Social Security and Medicare. Not understanding how these taxes apply can lead to underpayment and potential penalties. Always plan for these obligations when calculating your income.

Ensure Compliance and Avoid Penalties

Get Help to Start Your Business

LLC FAQs

Do I Need An Attorney To Form An LLC?

No, you don’t need an attorney to form an LLC. You can handle the process yourself through your state’s website or use an online service. However, consulting a lawyer can be helpful for complex situations.

What Is A Publication Requirement?

A publication requirement means publishing a notice of your LLC’s formation in local newspapers. This is only required in certain states, like New York and Arizona.

How Do I Ensure My LLC Always Has A Registered Agent?

You can either serve as your own registered agent or hire a professional service. Make sure the agent is always available during business hours and in the state where your LLC is registered.

How Do I Get An Ein For My LLC?

Applying online through the IRS website for an Employer Identification Number (EIN) is free and typically takes only a few minutes.

Can All Companies Be LLCs?

Most businesses can form an LLC, but certain industries, like banks and insurance companies, have restrictions. Always check your state’s guidelines to see if your business qualifies.

Conclusion

An LLC offers significant benefits, including personal asset protection, flexible management, and simpler compliance than corporations. It shields owners from business liabilities and allows for tax options to reduce the overall tax burden. This structure provides the balance many small business owners seek between flexibility and security.

Before deciding if an LLC is right for you, carefully consider your business needs, goals, and industry. Research state-specific requirements and consult with professionals for personalized advice. Understanding an LLC and its advantages can set your business on the right path to success.